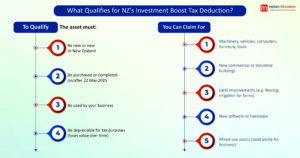

If you run a business in New Zealand, there’s great news: the government is giving you a new way to save on tax when you buy new business assets. This new rule is called Investment Boost. It started on 22 May 2025 and is designed to support business investment in new equipment, buildings, and other assets.

What is Investment Boost?

When your business buys a new asset, you can now:

– Claim 20% of the cost straight away as a deduction in your income tax return.

– Then, in the following years, you claim depreciation on the remaining 80% as if it were the full cost of the asset.

So, you get a bigger tax deduction up front and still claim depreciation as usual in later years.

What You Can Claim For 👇

What You Can’t Claim For

– Second-hand assets bought from within New Zealand

– Residential rental properties

– Most intangible assets like patents and trademarks

How to Claim It

You claim the 20% deduction in your income tax return for the year you buy the asset.

Then, in the following years, you claim depreciation on the remaining 80% of the asset’s cost—but treat that 80% as if it were 100% for calculating depreciation.

Real-Life Examples (with Depreciation)

1️⃣ Transport Business Buys Trucks and Builds a Fence

Queen City Carriers buys 4 new trucks at $75,000 each and builds a new fenced parking lot for $200,000.

Total spent: $500,000

Claim in 2026 Tax Return: 20% of $500,000 = $100,000 immediate deduction

Depreciation from 2027 onwards: Remaining 80% = $400,000

If trucks depreciate at 30% DV (diminishing value), treat the $400,000 for trucks as 100% → depreciate accordingly.

-Year 1: $120,000 (30% of $400,000)

-Year 2: $84,000 (30% of $280,000), etc.

2️⃣ Fish ‘n Chip Shop Buys Fryer

Jenaye’s Fish ‘n Chip Shop buys a commercial deep fryer for $2,500.

Claim in 2026: 20% = $500 immediate deduction

Depreciation from 2027: 80% = $2,000

If the depreciation rate is 20% DV:

– Then Year 1: $400

– Year 2: $320

– And Year 3: $256, and so on

3️⃣ Tech Company Buys Software & Hardware

Leith Logistics buys software license: $1,000,000 and hardware: $200,000

Total = $1.2 million

Claim in 2026: 20% = $240,000 immediate deduction

Depreciation from 2027: Remaining 80% = $960,000

Software (20% DV), Hardware (30% DV):

– Software Year 1: $160,000

– Hardware Year 1: $48,000

– And so on, using 960K as the base.

4️⃣ Taxi Company Buys Mixed-Use Car

Ella Taxis buys a car for $45,000.

After tracking for 90 days, they find the car is used 50% for work.

Claim in 2026: 20% of $45,000 = $9,000, Business portion: 50% = $4,500

Depreciation from 2027: 80% = $36,000, Business portion: 50% = $18,000

If the depreciation rate is 30% DV:

– Then Year 1: $5,400

– Year 2: $3,780

– And so on

What Happens If You Sell the Asset Later?

If you sell the asset for more than its adjusted tax value (i.e., cost minus deductions and depreciation), the extra profit may be taxable income — except for some farming land improvements.

💡Key Points to Remember

When it starts: 22 May 2025

Instant deduction: 20% of new asset cost

What happens next: Depreciate the remaining 80% normally

Applies to: New or imported business assets

Doesn’t apply to: Second-hand local assets, rentals, most intangibles

Why It’s Great for Businesses

– More cashflow upfront from the tax deduction

– Encourages reinvestment and upgrades

– Simple to apply in your income tax return

💭Final Thoughts

Investment Boost isn’t just another tax rule; it’s a strategic opportunity to reinvest in your business, unlock cash flow, and modernize faster.

Whether you’re expanding, upgrading, or just replacing old assets, the Investment Boost puts real dollars back into your business faster.

For compliance with the new tax regime contact Indian Muneem today!