Table Of Contents

Toggle

- Offshore Accounting

- Feb 19, 2026

Your firm’s reputation rides on every financial statement, tax return, and compliance report that leaves your desk. With expert offshore accounting services, you’re not only passing the work to another team; you’re trusting them to deliver the same standard of service to your customers as you expect to provide to them.

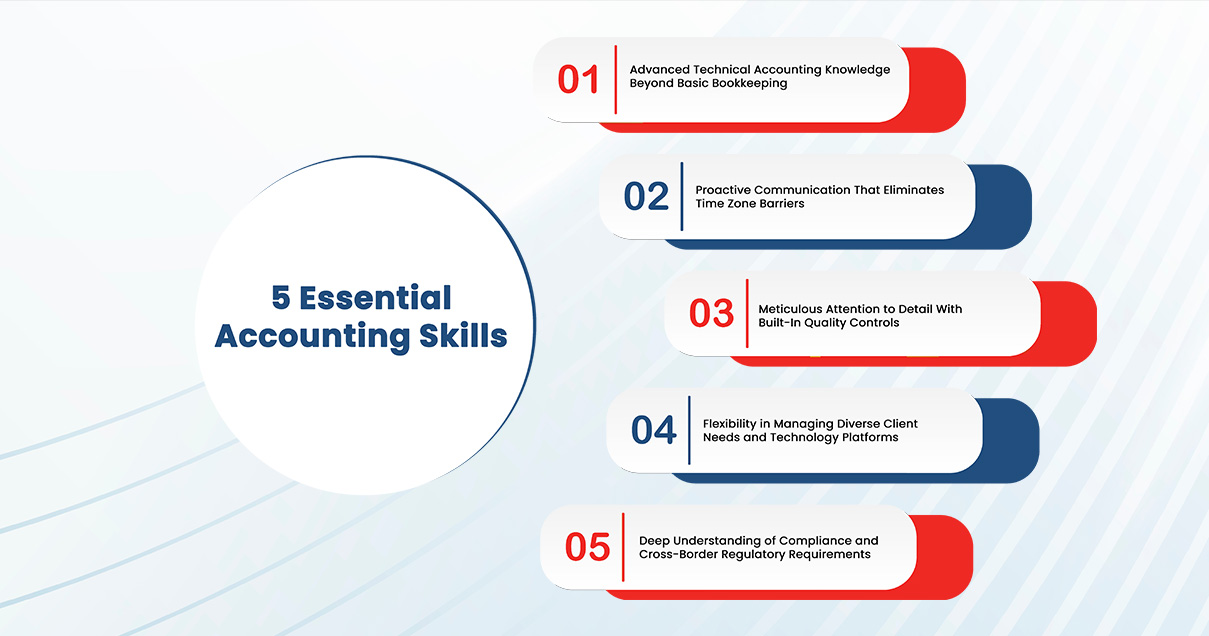

5 Skills That Define Expert Offshore Accounting Services

1. Advanced Technical Accounting Knowledge Beyond Basic Bookkeeping

Basic data entry won’t cut it anymore. Your offshore accounting partner needs professionals who genuinely understand accounting principles, not just how to record transactions. We’re talking about people who handle complex financial reporting, navigate GAAP and IFRS standards, and prepare financial statements that need minimal review.

2. Proactive Communication That Eliminates Time Zone Barriers

Communication failures kill offshore partnerships faster than technical mistakes. You’ve experienced this: sending urgent queries and getting responses 14 hours later that don’t actually answer your question. Or discovering issues that should’ve been flagged days ago.

3. Meticulous Attention to Detail With Built-In Quality Controls

Small errors compound catastrophically in accounting. A transposed digit in January becomes a December reconciliation nightmare. A missed depreciation entry affects every subsequent statement. This is why expert offshore accounting services don’t just hire careful people; they build systems that make errors nearly impossible.

Top offshore teams use multiple verification checkpoints, mandatory peer reviews, and automated accounting processes that flag anomalies automatically. When evaluating accounting services providers, ask: How many reviews does work go through? What’s their error rate? What happens when mistakes surface after delivery? For tax preparation and compliance management, your team should double-check everything with the same paranoia you would.

4. Flexibility in Managing Diverse Client Needs and Technology Platforms

5. Deep Understanding of Compliance and Cross-Border Regulatory Requirements

Anyone can learn software. Not everyone navigates the shifting landscape of tax compliance, regulatory reporting, and jurisdiction-specific requirements. When you offer expert offshore accounting services, you’re promising clients their financials will be handled correctly the first time.

Miss a filing deadline? Damaged client relationship. Misinterpret tax law? Firm liability. The best accounting outsourcing partners don’t just react to compliance, they anticipate it. Look for teams investing in professional development: memberships in accounting bodies, regulatory update webinars, and tax research subscriptions. For specialized industries like healthcare, real estate, e-commerce, and accounting, your offshore bookkeeping services partner needs specific expertise or the capacity to quickly develop it.

Making the Right Choice for Your Firm’s Growth

The offshore model works brilliantly when these five skills are present. It falls apart when they’re not. Your clients don’t care where their accounting gets done; they care that it’s done accurately, on time, by professionals who understand their business. When you choose offshore staffing partners with these capabilities, you’re building capacity to serve more clients better while protecting your reputation.

Indian Muneem Chartered Accountant delivers expert offshore accounting services built on these exact principles. Our teams combine technical expertise with the communication skills and quality systems your firm needs to scale confidently. Ready to experience the difference? Contact us today to discuss how we can become a seamless extension of your practice.

Follow Us: