Table Of Contents

Toggle

- Offshore Accounting

- Jan 20, 2026

The accounting industry has a peculiar relationship with the concept of change. For the last several decades, we’ve been refining our processes, our workflows, our best practices. Then AI walks in and flips the whole playbook on its head.

If you’re working with offshore accounting teams, you’ve probably noticed something shifting. The work your offshore team used to spend hours on is being done in minutes, or your accuracy rates have increased dramatically. Offshore accounting isn’t just about cost savings anymore; it’s smarter, faster, and more strategic than most firms realize.

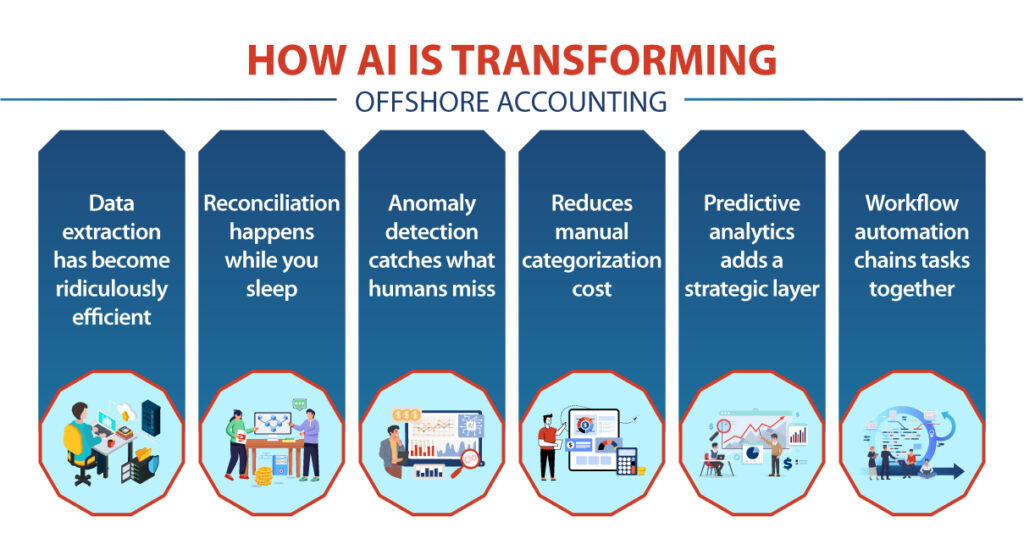

How AI Is Transforming Offshore Accounting

Let’s get into the specifics of what’s actually changing.

Data extraction has become ridiculously efficient

AI-powered OCR tools now pull information from invoices, receipts, and bank statements automatically with 95%+ accuracy. Your team receives preprocessed, structured data rather than raw documents. A task that consumed three hours of manual work now takes twenty minutes of review. For accounting firms handling dozens of clients, this adds up fast.

Reconciliation happens while you sleep

Bank reconciliation used to be that tedious monthly task everyone dreaded. AI now automatically matches transactions, identifies patterns, and flags only the exceptions that require human judgment. Your offshore accounting team focuses on resolving discrepancies, not finding them.

Anomaly detection catches what humans miss

Machine learning models analyze transaction patterns and flag anything unusual, like duplicate payments, unexpected charges, or transactions that don't match historical norms. Your offshore team gets these alerts in real-time. For CPA firms managing tax preparation and compliance, this additional oversight significantly reduces risk.

Smart categorization

AI reads transaction descriptions and understands context. It knows "Amazon Web Services" isn't office supplies. It learns from corrections and gets smarter. Your team spends less time categorizing and more time thinking about whether expenses make sense for the client's business.

Predictive analytics adds a strategic layer

AI models analyze historical data to predict future trends, such as cash flow patterns, seasonal variations, and potential shortfalls. Your offshore team can alert clients to potential issues weeks before they become problems. What used to be purely backward-looking compliance work now includes forward-looking insights. CFO services that seemed out of reach for offshore teams are suddenly feasible.

Workflow automation chains tasks together

When a bank statement arrives, AI extracts transactions, categorizes them, runs reconciliation, flags anomalies, and routes exceptions to the right team member. All automatically. For offshoring firms handling high volumes, this eliminates bottlenecks and speeds up the entire process.

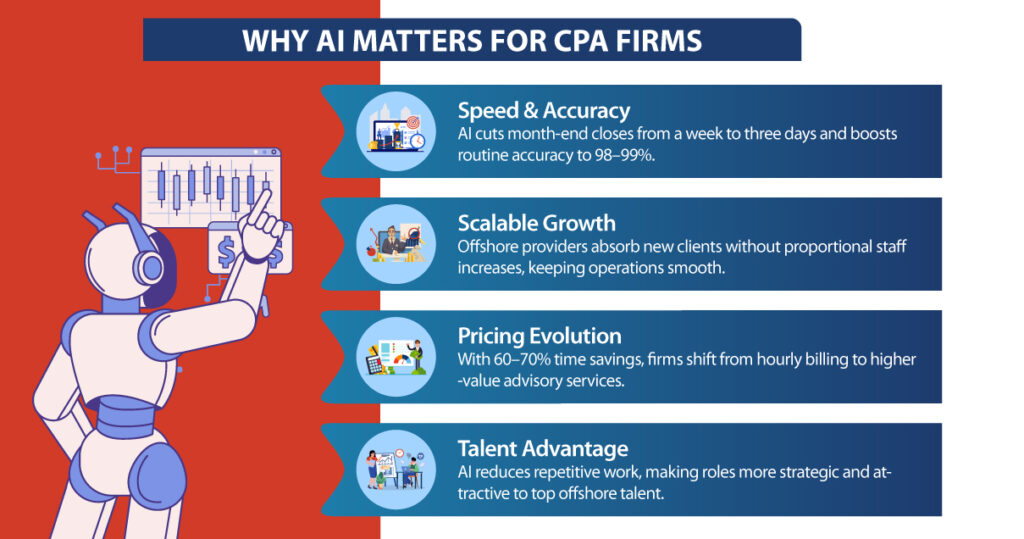

Why This Matters for CPA Firms

You might be thinking, “Great, AI makes offshore teams more efficient. But how does that actually impact my practice?” Here’s why this transformation should matter to every Partner and Managing Partner paying attention.

Speed and accuracy are now competitive weapons

Month-end closes that took a week now take three days. Tax preparation that needed two weeks wraps up in one. AI-enhanced offshore operations run at 98-99% accuracy on routine tasks. If your offshore accounting provider uses AI, you can confidently promise these timelines and accuracy rates. If not, your competitors already are.

You can actually grow without chaos

With AI-enhanced offshore accounting services, your provider absorbs new clients without adding proportional staff. The AI handles increased data volume. The team handles strategy and exceptions. You can pursue growth without worrying if your back office can keep up.

Your pricing model needs to evolve

If AI cuts routine work time by 60-70%, hourly billing becomes problematic. Clients won't pay the same for work that takes less time. But here's the opportunity: shift to higher-value services. Use efficiency gains to offer more business advisory and strategic planning. Outsourcing partners making this shift are capturing better margins while delivering more value.

The talent problem gets easier

Finding qualified accountants has been brutal. But when your offshore accounting team works with AI, you need fewer people for more work. Plus, the work is more interesting. They're analyzing and advising, not data entering. This helps attract and retain high-quality offshore talent, thereby improving service quality.

The Future: AI and Human Expertise Working Together

Let’s address the anxiety that comes up in every conversation about AI in accounting: Are we automating ourselves out of jobs?

No. But we are fundamentally changing what the job looks like.

The future of offshore accounting isn’t humans versus machines. It’s humans augmented by machines, doing work that neither could accomplish alone.

AI is known for its pattern recognition, data processing, and rule-based systems. Machines are capable of recognizing thousands of transactions within seconds, which are beyond human detection, with all logic being applied.

But what AI cannot do is infer the business context, handle uncertain scenarios, or establish relationships with clients. AI is incapable of reading between the lines in terms of the client’s anxiety, tailoring strategies to suit specific conditions, and using professional judgment in very complicated situations.

That’s where skilled accountants create irreplaceable value.

The best offshoring firms are already operating this way. Their teams use AI to eliminate mechanical work, freeing up time for the strategic thinking that clients actually pay for. An accountant who used to spend 70% of their time on bookkeeping services and reconciliation now spends that time on analysis, planning, and client communication.

This shift elevates the entire profession. Offshore accounting teams that once handled basic tasks are now providing payroll processing, management reporting, and financial analysis. Some are even taking on specialized work, such as multi-entity consolidations and complex tax preparation. The AI handles the computational heavy lifting. Human expertise applies judgement and strategy.

The best providers are doing the latter. They’re investing in AI infrastructure while also developing their people’s skills, such as training them in data analysis, client communication, and specialized accounting domains.

This human-AI partnership will deepen over the next few years. We’ll see AI handling increasingly complex tasks, such as preliminary financial statement preparation, multi-jurisdictional tax calculations, and regulatory reporting. But the final review, client presentation, and strategic recommendations? Those will remain firmly in human hands.

Making Your Move

The accounting industry is in the middle of a significant transition. For CPA firms, CA firms, and accounting firms working with offshore teams, this creates both opportunity and urgency.

The firms winning right now aren’t the ones with the most people or the lowest prices. They’re the ones who’ve figured out how to blend AI capabilities with skilled human expertise. Today’s best offshore providers are technology-enabled service partners who can handle sophisticated work at scale.

Firms that embrace this shift are already seeing the rewards. Indian Muneem Chartered Accountant is one of the offshore accounting partners leading this transformation by combining AI-driven efficiency with human expertise to deliver smarter, faster, and more strategic outcomes for CPA firms worldwide.

Follow Us: