Let’s be honest. Most people think forensic accounting and forensic auditing are the same thing. The words are tossed around in boardrooms, news headlines, and reports as if they mean exactly the same thing.

But they don’t.

And if you’re a CFO, partner at a CPA firm, legal counsel, or someone responsible for financial oversight, knowing the difference between forensic accounting and forensic auditing is not just helpful; it is essential.

You could hire the wrong expert, delay investigations, lose a legal battle, or fail to recover losses. All because you did not know which one to call in. This blog clears that up, once and for all.

The Core Idea Behind Forensic Accounting and Forensic Auditing

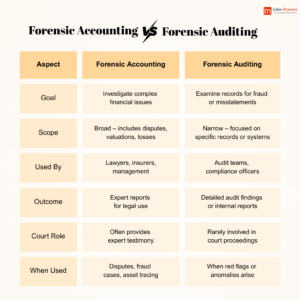

Both forensic accounting services and forensic auditing services involve the examination of financial data related to fraud, misconduct, or disputes. But they don’t go about it the same way. Think of forensic accounting as the wider umbrella—investigating financial discrepancies, tracing money trails, estimating losses, and supporting litigation. Forensic auditing is a more focused, evidence-driven review of financial statements or systems to uncover fraud or misstatements.

Let’s simplify it further.

If you want to know what happened to missing money, reconstruct messy transactions, or provide expert opinion in court, you need a forensic accountant.

If you want to check whether something went wrong in a specific area, like inventory records or vendor payments, through a systematic review, you need forensic auditing.

Why Does This Matter?

Because hiring the wrong professional or worse, assuming your regular auditor can “just do it,” can hurt your case, waste money, and destroy trust.

Let’s say you’re a New Zealand-based agritech firm expanding into Singapore. You suspect an internal stakeholder might’ve manipulated supplier contracts to extract personal benefit. If you go to your usual auditor and ask them to “just check if things are okay,” you’ll get an audit report. But what you needed was a forensic accounting investigation into the intent, the paper trail, the money flow, and the eventual impact on your company’s bottom line.

These aren’t minor differences; they change how legal cases are built, how insurance claims are filed, and how companies recover losses or clear reputations.

The Role of Forensic Auditing in Depth

Let’s now focus a bit more on forensic auditing, since that’s the keyword we’re working around and a key service area that often gets misunderstood.

Forensic auditing is like surgical accounting. It involves a defined process or record, such as procurement contracts, payroll systems, or general ledger entries. It scrutinizes it through multiple layers to establish an audit trail that highlights potential red flags. Not to simply say “I don’t like this process”, but rather have documentation that can stand up in court, arbitration, or settlement discussions.

Unlike a standard audit (which checks compliance), forensic audits look for:

- Intentional misstatements

- Patterns of fraud

- Misuse of funds

- Internal control failures

- Conflicts of interest

- Falsification of documents

The output is highly detailed, often legally admissible, and can be used by law enforcement, regulators, insurers, or management to take further action.

Important: Not all accountants are qualified to perform a forensic audit. Forensic reports can only be written by accountants with specialized training, a certain level of legal knowledge, and analytic investigative skills, as well as the ability to give evidence under oath, if necessary.

Let’s Look at a Few Real Examples

Example 1: Vendor Scam in Australia

A mid-sized retail company in Melbourne discovers that payments to one vendor appear to be inflated. A forensic auditor is called in to review those specific invoices, match them with delivery reports, and identify fake billing patterns.

Example 2: Employee Fraud in Canada

A senior accountant is suspected of diverting funds using shell companies over several years. A forensic accountant is hired to follow the trail of the money, calculate damages, and gather evidence for possible criminal action.

Example 3: Partnership Dispute in New Zealand

Two business partners sever ties after ten years. One claims the other has taken money from the profits. A forensic accountant has been retained to reconstruct the company’s financial accounts and assist with settlement discussions.

Final Thoughts: Don’t Confuse the Tools with the Job

In finance, precision matters. Calling a forensic accountant when you need an audit or expecting a forensic audit to reconstruct a five-year fraud, can cost you dearly. Understand what each one brings to the table.

Here’s the bottom line:

Forensic accounting is broadly investigative and often court-related work. Forensic auditing is narrow, review-based, and evidence-based work.

And both are critical in the fight against fraud, mismanagement, and financial disputes.

Need support?

This is exactly where Indian Muneem steps in. Quietly powering legal, audit, and finance teams with forensic accounting and auditing support across New Zealand, Australia, Singapore, the UK, US, Europe, and Canada. No fluff, no noise just clear, accurate, behind-the-scenes expertise when you need it most.