Table Of Contents

Toggle

- Offshore Bookkeeping

- Feb 03, 2026

Let’s cut through the noise. Your startup just closed a funding round, or your SME is scaling faster than anticipated. Fantastic. But here’s what nobody tells you: the bigger you grow, the messier your books get. And suddenly, you’re drowning in invoices, reconciliations, and compliance deadlines while your core business screams for attention.

Offshore bookkeeping services solve this exact problem. They’re not just about saving money; they’re about reclaiming your time and getting professional financial management without the overhead of hiring full-time staff. For startups and SMEs looking to optimize operations, this model has become the most efficient way to handle accounting.

How Offshore Bookkeeping Services Work

The truth is, the process is much simpler than you think. When you outsource your bookkeeping services to an offshore bookkeeping company, what you are essentially doing is gaining access to a team of accountants who work remotely but are fully integrated into your business operations.

This is how it really works: You upload your financial data, such as invoices, receipts, bank statements, and bills, to cloud-based accounting software such as QuickBooks, Xero, or Zoho Books. The offshore bookkeeping team can then access this information through secure and encrypted channels.

Your transactions get recorded daily. Every sale, purchase, payment, and receipt is categorized accurately according to your business structure. Bank accounts get reconciled regularly to catch discrepancies early. Monthly financial closes happen on schedule without you chasing anyone.

Financial statements, profit and loss statements, balance sheets, and cash flow reports are prepared and delivered within agreed-upon timelines. You get clear visibility into your business finances without doing any of the heavy lifting yourself.

The timezone difference actually works in your favor. While you’re wrapping up your business day, work continues in a different timezone. That financial report you need? It’s ready when you start your morning. The monthly close that used to stress you out? It happens smoothly because there’s a continuous workflow.

Technology makes the distance irrelevant. Real-time dashboards show your financial position anytime you want to check. Communication happens via email, Slack, video calls, or any platform that works for your business. The remote bookkeeping setup feels less like working with an external vendor and more like having an efficient accounts department that simply operates from a different location.

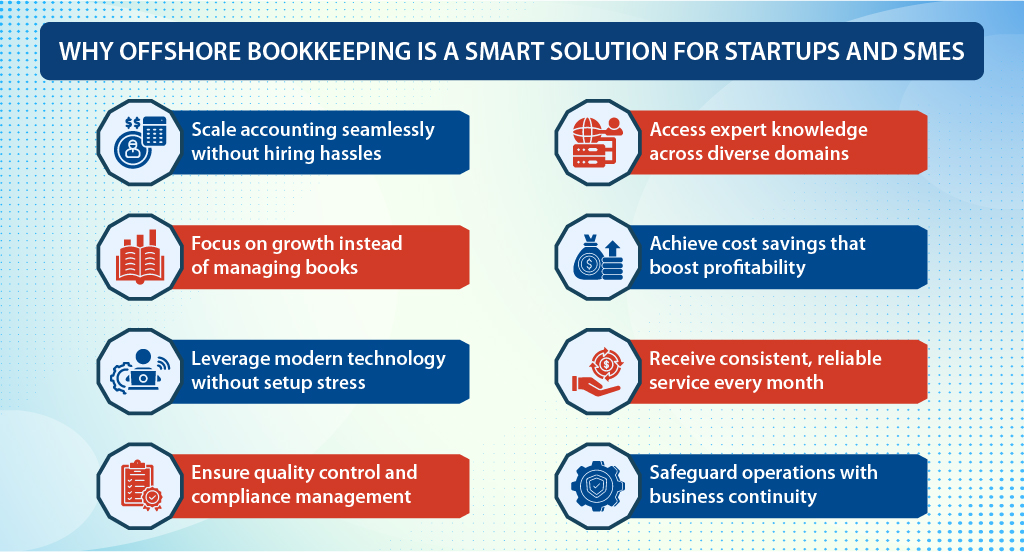

Why It’s a Smart Solution for Startups and SMEs

Scale Your Accounting Without Hiring Headaches

Your business doesn’t grow predictably. Some months you process 100 transactions; other months, it jumps to 800 after landing a major contract or launching a new product line. Hiring full-time staff during this volatility means paying salaries when there’s insufficient work, or drowning in a backlog while recruiting and training a new employee.

Offshore bookkeeping services solve this. Need more support during the busy season? The team expands. Business slowed down temporarily? Resources adjust without awkward conversations or severance payments. You pay for what you need, when you need it, keeping the cost of bookkeeping services variable rather than fixed overhead that can pressure your cash flow during lean periods.

Get Expert Knowledge Across Multiple Areas

E-commerce businesses need inventory accounting. Service companies require project-based costing. Manufacturers struggle with work-in-progress tracking. If you’re dealing with international transactions, compliance gets complicated quickly. Finding one person who understands all these nuances locally is nearly impossible, and when you do, retention becomes a constant concern.

Offshore accounting services provide access to teams with diverse specializations. Your e-commerce business gains access to inventory management experts. Your manufacturing operation works with production costing specialists. Handling multi-currency transactions? There’s expertise in foreign exchange accounting and international compliance. This depth elevates your financial management from basic bookkeeping to strategic advantage, enabling better decisions from people who genuinely understand your industry’s specific challenges.

Focus on Growing Your Business, Not Managing Books

You began your business to help customers, create products, or solve problems. Nobody gets into business to spend their evenings balancing bank statements or entering invoice information. And yet, many business owners find themselves stuck there instead of doing the things that will actually make money.

Offshore bookkeeping practice includes services such as data entry, transaction recording, bank reconciliations, vendor payment tracking, and customer collection tracking. More time is therefore freed to do what really matters: growing your business through customer acquisition, product development, new markets, team growth, and partnerships. When you want to access financial information that informs your decision-making, it is readily available and reliable without taking away from productive cycles of work.

Dramatic Cost Savings That Strengthen Your Bottom Line

Hiring a competent full-time bookkeeper in major markets comes with high costs like salaries, employee benefits, office space, equipment, software licenses, and ongoing training expenses. You’re looking at a substantial annual investment for a single person to handle fixed capacity.

Offshore end-to-end bookkeeping solutions give you an entire team of bookkeepers for a fraction of that cost, multiple professionals with diverse skill sets who together can manage much more volume because they are experts and efficient. This is a significant difference for startups that are watching every penny and small to medium-sized businesses that are operating on thin margins. The cost of bookkeeping services changes from a necessary expense to a valuable resource that helps improve your bottom line.

Modern Technology Without Implementation Headaches

Cloud-based accounting software such as QuickBooks, Xero, and Zoho Books provides powerful functionality such as automated bank feeds, invoice creation, expense tracking, financial reporting, and compliance capabilities. However, the effective implementation of such solutions is not possible in-house by small businesses.

Set them up wrong, and you’re stuck with messy data that takes months to clean up. Your chart of accounts is disorganized. Reports don’t make sense. Tax preparation becomes a nightmare. You wanted technology to make life easier; instead, it created new problems you don’t have time to fix.

Professional offshore bookkeeping providers have implemented these platforms hundreds of times across different industries. They understand how to organize your accounts, how to set up automation rules, how to integrate with other business tools such as inventory management or CRM software, and how to optimize your workflows for maximum efficiency. You are getting technology expertise, along with bookkeeping, which is a great combination for small business accounting outsourcing that requires advanced financial infrastructure but cannot afford a full-time technology expert.

Consistent, Reliable Service Every Single Month

Employee turnover creates chaos in small businesses. You finally train someone on your specific bookkeeping requirements, establish workflows, build institutional knowledge, and then they resign for a better opportunity or relocate. You’re back to square one, interviewing candidates, training someone new, dealing with errors while they learn, and hoping this person stays longer than the last one.

Offshore bookkeeping services eliminate this vulnerability through team-based delivery models. Your work isn’t dependent on one person who might leave; it’s supported by multiple professionals with documented procedures and established protocols. Someone goes on leave? Another trained team member continues the work without interruption. Someone resigns? The transition happens internally to the provider and doesn’t affect your service at all.

This reliability matters enormously when you’re running a business. Your financial statements arrive on schedule every month without excuses. Reconciliations happen consistently. Invoice processing doesn’t stop because someone called in sick. Tax returns get filed on time, every time. This predictability allows you to plan better and removes a constant source of operational stress. For small business bookkeeping services, this operational stability often proves more valuable than the cost savings alone.

Built-In Quality Control and Compliance Management

The rules and regulations regarding taxes are constantly changing. The requirements for compliance are being updated. The reporting norms are shifting. For small business owners already juggling multiple tasks, keeping up with all these norms while running the business day to day is just too much.

One mistake, one missed payment, one incorrect filing, one incorrect classification, and you are facing penalties, notices, and interest charges, not to mention the hassle of sorting out the problem with the tax authorities. The cost is bad enough; the time and effort wasted in resolving these issues are even more significant and pull you away from the actual business.

Experienced offshore accounting and bookkeeping firms incorporate compliance into their regular processes. They maintain up-to-date checklists, have review procedures in place, set up automated notifications for unusual transactions, perform quality audits, and stay ahead of regulatory changes as part of their professional obligations to all their clients.

Because they’re handling volume across many clients, they can justify investing in sophisticated compliance management systems and ongoing training that would be excessive for individual small businesses to maintain. Your startup benefits from this enterprise-grade quality control without paying enterprise prices. The virtual bookkeeping services model makes this possible because technology enables the consistent application of standards and shares expertise efficiently across numerous clients.

Business Continuity That Protects Your Operations

Local disruptions will occur. Natural disasters, power outages, internet disruptions, health crises, or personal emergencies are bound to happen. When your entire accounting system is reliant on one local staff member or the business owner themselves, these types of disruptions will bring your financial systems to a grinding halt. Bills won’t go out. Payments will be late. Month-end closings will be late. Tax returns will be filed at the last minute, causing unnecessary stress and possible penalties.

With outsourced bookkeeping, there is automatic redundancy and backup. Disruptions at one location won’t bring all activities to a halt. The team has business continuity plans, power, and internet systems in place.

This is especially important for startups and SMEs, which rely on the timely execution of financial operations for everything from paying suppliers to submitting financial reports to investors and loan applications. When you keep your accounting processes running smoothly even during disruptions, you ensure that not only your financial statements but also your entire business ecosystem remain safe. Suppliers continue to receive payments on time, and your relationships with them remain good. Customers continue to receive their bills on time, and your cash flows improve. Banks and investors continue to receive your financial reports, and your confidence as a manager is boosted.

Ready to Transform Your Financial Management?

Offshore bookkeeping services work brilliantly when you’re ready to stop treating bookkeeping as something you’ll “eventually get to” and start treating it as the business foundation it actually is. Running a business is already demanding enough without adding a full-time accounting job to the mix. The sooner you hand that off, the sooner your business gets the attention it actually needs.

At Indian Muneem Chartered Accountant, we provide comprehensive offshore bookkeeping services tailored to startups and SMEs. Our team handles everything from daily transaction recording to monthly financial reporting, tax compliance, and beyond, giving you accurate, timely financial insights without the overhead of hiring full-time staff.

Follow Us: