Table Of Contents

Toggle

- Financial Reporting

- Jan 27, 2026

Let’s cut to the chase here. The world of accounting is changing under our very noses, and you’d best be keeping up with where the international financial reporting standards are going, or you’ll be scrambling to get caught up.

For organizations that provide services to the business world, dealing with cross-border transactions and global compliance, being at the forefront of IFRS trends is more than checking a box to stay compliant. In the end, it’s a message about why your business solution is the most critical when your clients have their next audit, investor presentation, or expansion opportunity.

What Exactly Are International Financial Reporting Standards?

What this means for any business or enterprise is a systematic way to handle its clientele, including global business, foreign investors, and those targeting global markets. The implication of standardizing approaches is clarity, precision, and, most importantly, reduced risk of misinterpretation, which could lead to unsuccessful negotiations or regulatory investigation.

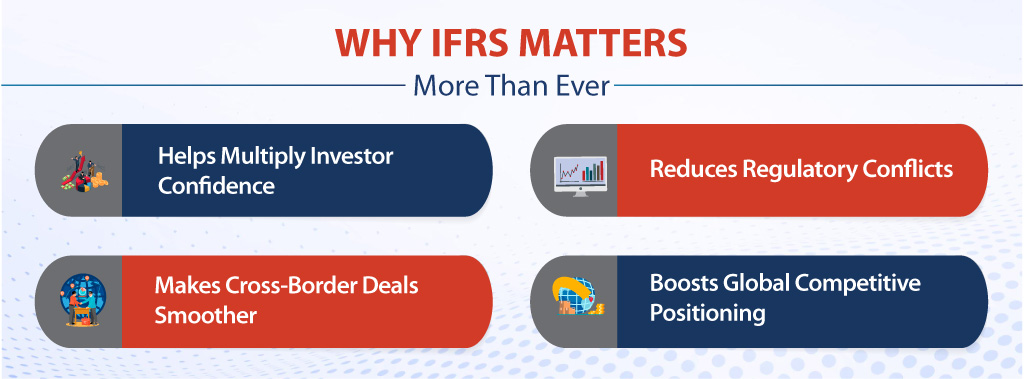

Why IFRS Matters More Than Ever

Investor confidence multiplier:

When your client's books speak IFRS, international investors don't need translators. They can assess risk, value, and potential without second-guessing whether the numbers mean what they think they mean.

Cross-border deal facilitator:

Mergers, acquisitions, and joint ventures become significantly smoother when both parties already speak the same accounting language. Your firm saves countless hours that would otherwise be spent on reconciliation.

Regulatory alignment:

With increased adoption or convergence to IFRS, you will be working within a framework with fewer compliance conflicts. A single set of books may meet many regulatory requirements across multiple markets.

Competitive positioning:

Companies reporting under IFRS signal sophistication and global readiness. For your clients pursuing international contracts or partnerships, this credibility opens doors that might otherwise remain shut.

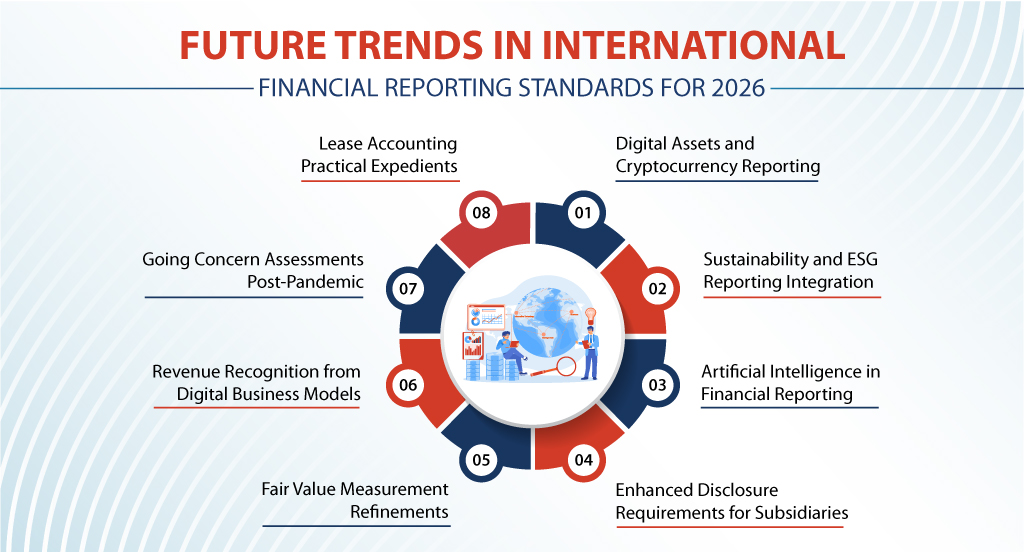

Future Trends in International Financial Reporting Standards for 2026

Digital Assets and Cryptocurrency Reporting

For your practice, this means developing expertise in blockchain verification and understanding crypto exchanges well enough to validate client holdings. The volatility reporting requirements will require more frequent client touchpoints, particularly around quarter-end and year-end.

Sustainability and ESG Reporting Integration

Artificial Intelligence in Financial Reporting

Enhanced Disclosure Requirements for Subsidiaries

This matters particularly for your clients with complex structures, such as holding companies, private equity portfolios, or businesses that use special-purpose vehicles for financing. The “why” behind consolidation decisions will matter as much as the “what.”

Fair Value Measurement Refinements

IFRS 13 is getting attention again, particularly around measurement uncertainty and the hierarchy of inputs for fair value calculations. With markets experiencing unprecedented volatility, the IASB is providing additional guidance on when Level 3 inputs are appropriate and how to document significant assumptions.

Expect stricter requirements around sensitivity analysis and disclosure of measurement uncertainty. When your client values an illiquid asset or a complex derivative, the range of possible values and the key assumptions driving your valuation will need much more thorough documentation.

For firms, this means either developing in-house valuation expertise or establishing reliable relationships with valuation specialists. The days of back-of-envelope fair value estimates are definitely over.

Revenue Recognition from Digital Business Models

Your clients in SaaS, e-commerce, and digital platforms need this clarity desperately. The principles remain consistent, but the application examples and implementation guidance being developed will resolve many grey areas your firm currently navigates on judgment alone.

Going Concern Assessments Post-Pandemic

It is clear from the pandemic experience that “going concern” can shift from a formalized status to a serious concern quickly. Newer guidance is emerging on the length of the look-forward period, the quality of management’s projections, and the requirements of disclosures where material uncertainties exist.

Lease Accounting Practical Expedients

Wrapping It Up

Of course, building these capabilities in-house isn’t always practical, especially when client demands are already stretching your resources thin. That’s exactly why Indian Muneem Chartered Accountant exists as your offshore accounting partner, handling complex financial reporting, while you focus on client relationships and growth. We’re already navigating these IFRS trends for firms.

Ready to expand your service capabilities without expanding your headcount?

Follow Us: