Table Of Contents

Toggle

- Farm Accounting

- Jan 22, 2026

But farm accounting for beginners isn’t so bad. Whether it’s dairy farming or managing land for growing, it’s essential to understand where your farm stands financially. Here’s how you can break down what you truly need to understand.

What Exactly Is Farm Accounting?

Essential Farm Accounting Fundamentals for Beginners

Track Every Transaction Religiously

Your bank statement isn't enough. Record every dollar that flows in and out. Feed purchases, livestock sales, fuel costs, contractor payments, and even that roll of wire you picked up from the rural supplies store. Use accounting software designed for agriculture that can handle GST calculations and generate reports your accountant will actually want to see. Cloud-based systems mean you can update records from your phone while standing in the yards, not just when you're back at the farmhouse.

Master Cash vs Accrual Accounting Methods

Cash accounting records transactions when money actually changes hands. It’s simple, but it can distort your true financial position. Accrual accounting recognizes income when earned and expenses when incurred, giving you a more accurate picture of profitability. Most established farms use accrual because it better reflects the reality of agricultural operations, where you might sell lambs in June but not get paid until July. Understanding both methods helps you choose what works for your operation size and structure.

Set Up a Farm-Specific Chart of Accounts

Generic accounting categories won't cut it. Your chart of accounts needs to reflect agricultural realities, categories for different livestock classes, crop types, fertilizer and chemicals, irrigation costs, animal health expenses, and breeding stock. Break down income streams separately (wool, meat, milk, grain) and categorize expenses by enterprise if you're running multiple operations. This granular approach reveals which parts of your farm actually make money and which might need rethinking.

Understand Livestock and Crop Valuation

Your stock isn't just assets; it's living, growing inventory that changes in value constantly. Livestock valuation methods include cost price, market value, or standard value systems. In New Zealand, the Herd Scheme lets you value certain livestock at predetermined rates. Crops in the ground also need valuation, from planting costs to harvest expectations. Getting this right affects your profit and loss statement dramatically and determines your tax liability.

Maintain Separation Between Personal and Business Finances

Mixing your family's grocery run with farm fuel purchases in the same account is asking for headaches. Open dedicated business bank accounts and credit cards. Pay yourself a regular wage or drawings that you actually record. This separation makes tracking farm expenses infinitely easier, protects you during audits, and gives you clear visibility into whether your farm truly supports your lifestyle or if you're subsidizing it from off-farm income.

Monitor Key Financial Ratios and Benchmarks

Numbers alone are meaningless. You need to calculate your working capital ratio to ensure you can pay your bills. Monitor your debt-to-asset ratio to leverage. Compare your inputs per unit of production (per hectare, per head, per kilo) to industry norms. All this data informs you how your operation is heading towards solvency or potential trouble long before it hits your bottom line.

Plan for Seasonal Cash Flow Fluctuations

Unlike businesses with steady monthly revenue, farms experience feast and famine. You might have 70% of your annual income arrive in a two-month selling period. Map out your cash flow projections for the entire year, accounting for when major expenses hit versus when income arrives. Build reserves during good months to cover lean periods. Consider facilities like seasonal finance or overdrafts to smooth out these natural fluctuations without causing stress or missed opportunities.

Keep Impeccable Records for Tax and Compliance

The tax office isn't sympathetic to lost receipts or “rough estimates.” Maintain organized records of all transactions, keep invoices and receipts (digital copies work great), document livestock purchases and sales with proper stock reconciliation, and track capital improvements separately from repairs. Good record-keeping also helps with claiming depreciation on machinery and buildings, substantiating losses if disaster strikes, and proving your position if ever questioned by authorities.

Consider Offshoring Your Farm Accounting Services

This might surprise you, but many progressive farming operations now offshore farm accounting tasks to specialized providers. Instead of struggling through bookkeeping yourself or paying premium local rates, you can access qualified accountants who understand agricultural businesses at a fraction of the cost. They handle daily transaction recording, reconciliations, financial reporting, and compliance work while you focus on what you do best: farming. The time difference often works in your favor, with updated books waiting for you each morning.

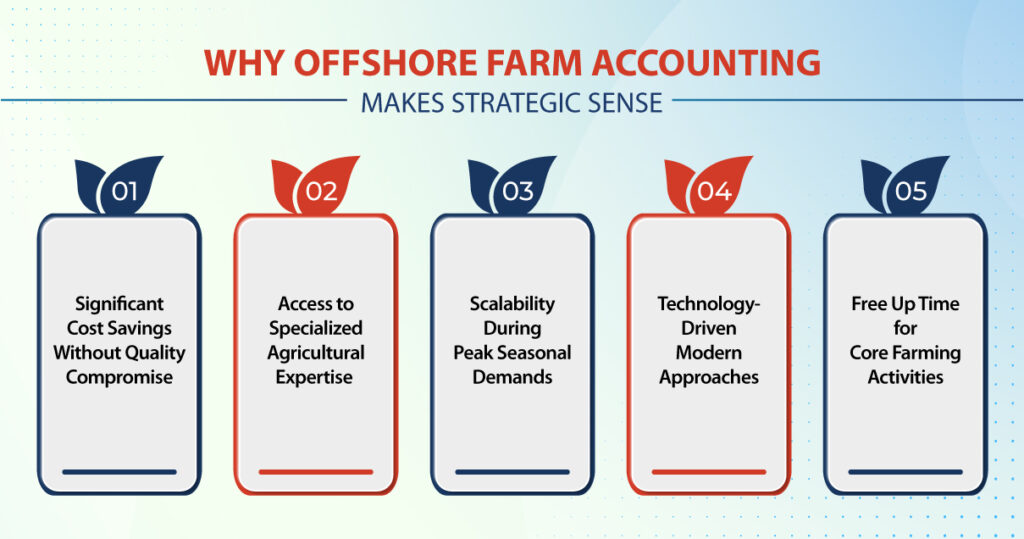

Why Offshore Farm Accounting Makes Strategic Sense

Significant Cost Savings Without Quality Compromise

Offshoring accounting functions typically costs a lot less than hiring locally or engaging traditional firms. You're not getting cheaper quality; you're accessing qualified professionals in markets with lower operating costs. For farming operations watching every dollar, this difference can fund a new piece of equipment or buffer against a tough season while still maintaining professional financial management.

Access to Specialized Agricultural Expertise

Offshore accounting firms specifically hire and train staff in agricultural accounting nuances. They understand livestock tracking, seasonal income patterns, rural industry-specific tax treatments, and compliance requirements across both countries. You get specialists who've worked with hundreds of farms rather than a generalist local bookkeeper learning on your dime.

Scalability During Peak Seasonal Demands

Shearing season, calving, harvest, these periods crush farmers with workload. Offshore providers can quickly scale up resources to handle increased transaction volumes, process more invoices, or generate additional reports without you needing to hire temporary staff. When the season ends, you scale back down with no redundancy costs or staffing headaches.

Technology-Driven Modern Approaches

Offshore accounting firms invest heavily in cloud-based systems, automation tools, and secure data platforms because technology is their competitive advantage. You benefit from sophisticated accounting software, automated bank feeds, digital receipt capture, and real-time reporting dashboards that many local providers still haven't fully embraced. Your financial data becomes more accessible and actionable.

Free Up Time for Core Farming Activities

Farm bookkeeping steals hours from your week, hours better spent checking stock, maintaining equipment, planning rotations, or simply getting proper rest. Offshoring this administrative burden gives you those hours back. You review reports and make decisions rather than wrestling with data entry and reconciliation. The mental load reduction alone improves both farm management and quality of life.

Wrapping It Up

Farm accounting for beginners isn’t about becoming a CA overnight. It’s about building systems that give you financial visibility and control. Start with solid fundamentals, which are accurate recording, appropriate methods, proper separation, and meaningful analysis.

If you’re looking for specialized offshore accounting support that understands the unique challenges of agricultural operations, Indian Muneem Chartered Accountant has been helping farms across New Zealand streamline their financial management while reducing costs.

Follow Us: