You don’t need a bigger office. You don’t need more desks, devices, or coffee machines. What you need is the right virtual accounting staff. Skilled professionals who know your client expectations inside out can take over entire functions and help your firm scale without the overheads.

That’s exactly what forward-thinking accounting firms worldwide are doing right now.

The talent shortage? It’s real. Margins? Squeezed. Client expectations? Sky high.

Outsourcing virtual accounting staff is becoming the default. But there’s one common question we keep hearing from partners and directors in the accounting space:

“What accounting roles can actually be outsourced today without compromising quality or control?”

Let’s answer that in plain English, with clear pointers, and from the lens of firms like yours, not the end clients.

Why firms are shifting to virtual accounting staff?

Let’s be clear: this isn’t about replacing people. It’s about realigning your team’s energy.

- Senior CAs shouldn’t be stuck cleaning up ledgers.

- Partners shouldn’t burn weekends chasing payroll issues.

- Mid-level staff shouldn’t be maxed out because you can’t hire fast enough.

Virtual accounting staff fill these exact gaps. They give you access to skilled, qualified professionals, without recruiting delays, training overheads, or local hiring constraints. And they come trained on global accounting software (think Xero, QuickBooks, Sage, NetSuite, MYOB).

For instance, we don’t just provide staff, we provide specialized roles backed by accounting expertise. You’re not outsourcing work. You’re outsourcing accountability, precision, and reliability.

What accounting roles can be outsourced?

Let’s break this down into real roles your firm could start outsourcing today. This isn’t fluff—it’s based on actual use cases and services that we at Indian Muneem also provide.

1. Bookkeepers (and not just entry-level ones)

Think daily bookkeeping, but smarter.

- VAT/GST return prep

- Bank reconciliations

- General ledger maintenance

- Client-specific data entry workflows

- Chart of accounts management

The best part? Bookkeepers can be onboarded in 24–48 hours and start working on multiple clients right away.

Bonus: If you deal with agri, retail, or eCom clients, you can request industry-specific bookkeeping experience.

2. Payroll Specialists

This one’s a massive time-saver.

Virtual payroll staff can:

- Run multi-country payrolls

- Handle compliance

- Create salary structures

- Track leave and entitlements

- Maintain digital payroll records

It’s not just number-crunching—it’s peace of mind for your clients and fewer fire drills for your in-house teams.

3. Accountants & Tax Experts

The real backbone of your compliance engine.

Outsourced accountants can:

- Prepare tax computations

- File returns on your behalf

- Manage fixed asset registers

- Handle ledger closures

- Assist in cost accounting

You don’t have to offload everything at once. Start small with 1-2 client files and scale as trust builds.

4. Audit Support Staff

We don’t sign off audits, but we support audit firms with:

- Sampling & testing

- Preparing lead schedules

- Reviewing internal controls

- Validating financial health checklists

- Drafting management letters

This is one of the most in-demand virtual accounting staff profiles right now, especially during peak seasons.

5. CFO-Level Consultants (Virtual, Yet Executive)

Not every client can afford a full-time CFO. But your firm can offer CFO-level insights by hiring virtual financial strategists who:

- Create budgets and forecasts

- Analyze margins, cost centers, and cash flow

- Offer M&A readiness support

- Present board-level insights

This is especially powerful for firms working with startups, growth-stage businesses, or high-net-worth individuals who need advisory but not full-time support.

At Indian Muneem, many of our virtual CFO consultants work alongside in-house client managers, acting as an invisible extension of the firm’s advisory team.

6. Forensic Accountants

Yes, even this can be outsourced.

Firms looking to:

- Investigate financial discrepancies

- Support litigation or insurance cases

- Handle business valuation or fraud detection

…can easily tap into offshore forensic specialists with deep analytical and legal understanding. These are not generalists. They come with niche training in tracing, analyzing, and documenting financial irregularities.

7. Accounts Payable & Receivable Teams

If your firm handles bookkeeping for mid-sized businesses, having a dedicated AP/AR team can significantly speed up the process.

They can:

- Chase receivables

- Reconcile vendor statements

- Prepare payment batches

- Track aging reports

- Flag discrepancies to your client’s in-house teams

This ensures your client’s books are always clean, and your firm is not caught in last-minute cleanup chaos.

What firms need to watch out for

Of course, outsourcing isn’t a plug-and-play magic trick. You need the right process, controls, and expectations.

Here’s what we recommend (and implement ourselves):

1️⃣ Start small. Begin with a low-risk function like bookkeeping or AP/AR.

2️⃣ Set up SOPs. Standard Operating Procedures keep everyone aligned.

3️⃣ Insist on real-time collaboration. Use Slack, Teams, Zoom, whatever works. But stay in sync.

4️⃣ Use shared accounting software. Cloud-based tools like Xero or QuickBooks make remote work seamless.

5️⃣ Maintain review loops. Offshore doesn’t mean offhanded. Always have internal quality checks.

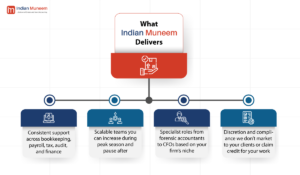

Where Indian Muneem Fits In

We provide virtual assistance to accounting firms across NZ, AUS, SG, US, UK, Europe, and Canada, and work behind the scenes.

And most importantly: no fixed contracts, no long onboarding delays, no micromanagement required.

Just expert-level work, quietly delivered.

Final Thoughts 💭

The longer firms wait, the more they’re stuck:

- Burning hours on low-value tasks

- Saying no to new clients because the team’s at capacity

- Missing out on margins they could have easily protected

Hiring virtual accounting staff gives you flexibility, speed, and access to global talent without compromising your brand or client experience.