There is this hesitation from most firms when it comes to onboarding an offshore accounting team: “What if it breaks the flow of how we work?” This is a genuine concern, of course; you are at a good rhythm with your staff, clients are doing things a particular way, and the last thing you want is upheaval in the middle of tax season or audit preparation.

But here’s the thing. Offshore doesn’t have to mean off-balance. The problem isn’t the offshore team, it’s the onboarding. That’s where most disruptions happen. But it’s fixable. You need the proper process and a few practical adjustments.

So let’s walk through this together. You’ll learn how to set things up smoothly, avoid workflow shocks, and make your offshore accounting team feel like an extension of your in-house crew, without adding chaos to your calendar.

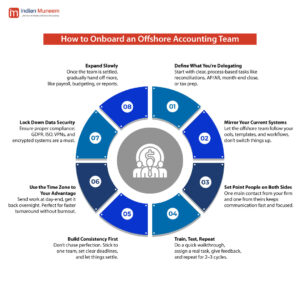

Steps to Onboard an Offshore Accounting Team

Step 1: Know What You’re Actually Delegating

This sounds obvious, but it’s where most people get it wrong. Before you even think about onboarding, get clear on what work you’re handing off.

Start by mapping out:

- What are the repeatable, time-heavy tasks your internal team spends hours on?

- What tasks don’t need direct client interaction?

- What needs technical expertise, but not necessarily local presence?

A few great places to start:

- Bank reconciliations

- Accounts payable/receivable

- Month-end closing

- General ledger maintenance

- Basic tax prep

- Cleanup projects during low seasons

When you’re specific from the start, the offshore team hits the ground running. You’re not “trying things out.” You’re handing them something with purpose. That confidence changes everything.

Step 2: Set Up a Mirror, Not a New System

This is where most onboarding falls apart. The offshore team comes in, but their work style is different. Some will use different templates, with different naming conventions, and others will just plan it out in a logic they create.

The trick? Mirror your current systems and processes.

Here’s how:

- Share your SOPs (Standard Operating Procedures). Even if they’re not perfect. Start with something.

- Set up access to the same tools: Xero, QuickBooks, MYOB, NetSuite, Excel macros—whatever you use.

- Stick to your checklists, your formats, your workflows. You don’t need to reinvent anything.

If they’re good, they’ll adapt fast. If not, you’ll know early.

Step 3: Pick 1-2 Point People on Both Sides

Here’s an insider tip that most people ignore: Communication is smoother when fewer people are in charge of it.

Designate:

- One point person from your firm (someone senior enough to answer questions)

- One point person offshore (who owns the updates, the task lists, and the tracking)

This structure:

- Cuts out confusion

- Avoids the “too many cooks“ problem

- Speeds up decision-making

- Prevents miscommunication during crunch time

Use a tool like Slack or Microsoft Teams for daily touchpoints. But also set a quick weekly video call to review big-picture stuff and clear bottlenecks.

Step 4: Train Once. Then Test.

Don’t spend weeks hand-holding.

Here’s a better plan:

- Train them on your workflows with a screen share.

- Walk through a live file or client case.

- Assign a small batch of real work with a 2-day turnaround.

- Review. Give feedback. Repeat.

After 2–3 of these cycles, you’ll know:

- Are they picking up fast?

- Do they understand the details, or are they just ticking boxes?

- Is the communication working?

Step 5: Don’t Expect Magic. Build Consistency

Some companies onboard a remote or offshore accounting team and expect results right away. But there is a learning curve, much like what you would experience if you hired someone in-house.

Instead of chasing perfection right away, build consistency:

- Set clear deadlines and deliverables

- Use shared trackers or project management tools (like ClickUp, Trello, or Monday)

- Record SOP videos for repetitive tasks

- Encourage your team to ask questions instead of guessing

And here’s the big one: stick to one offshore team. Switching providers every few months because of tiny issues? That’s what messes up your workflow.

Give your offshore team time to settle, grow, and understand your business. The ROI comes after consistency kicks in.

Step 6: Use Time Zone Differences to Your Advantage

If you’re in Australia, New Zealand, or the U.K., and your offshore team is in India, you’ve got a built-in advantage.

Let’s say:

- You send work at 5 PM your time.

- They finish it overnight.

- You start your day with the work already done.

This is how firms cut turnaround times in half without anyone working overtime.

Just make sure there’s a 1–2 hour overlap between your team and the offshore team for real-time communication. That’s all you need.

Step 7: Protect Client Data and Keep Things Compliant

This is a non-negotiable. Any offshore partner must follow:

- GDPR (for U.K./EU clients)

- HIPAA (if any healthcare-related accounting is involved in the U.S.)

- Data protection regulations for Australia, NZ, Canada, etc.

Ask your offshore partner:

- Do they have secure servers and end-to-end encryption?

- Who has access to what?

- Are they ISO certified?

- How do they handle breaches?

Step 8: Celebrate Wins, Share Feedback, and Grow the Scope

Once the offshore team is handling their initial tasks well, gradually expand their scope.

Think:

- Can they help with budgeting or forecasting?

- Can they prep reports for CFO reviews?

- Can they assist with payroll processing or compliance filings?

At the same time, provide feedback consistently. Not only when something does not go right but also when things go right.

This builds trust. And trust is what will turn a normal offshore team into a real extension of your company.

Key Takeaways

✅ Be clear on what you’re outsourcing – Choose tasks that are repeatable and process-driven.

✅ Mirror your systems – Don’t change your workflow to fit the offshore team. They should adapt to you.

✅ Appoint point people – One contact person on each side keeps communication focused and fast.

✅ Train, test, repeat – Keep it lean. Do live walkthroughs, assign work, give feedback.

✅ Build consistency first – Don’t chase perfection early. Let the team settle in.

✅ Use the time zone – Get overnight work done and cut turnaround time.

✅ Prioritize security – Only work with teams that take compliance and data protection seriously.

✅ Grow the relationship – Share wins and slowly expand the offshore team’s role.