Bookkeeping is a task that quietly consumes your most valuable hours. You don’t notice it at first, reconciling a few transactions here, chasing an invoice there, but before you know it, you’re spending late nights cleaning up receipts or correcting tax codes. This is time you could have spent making strategic decisions, managing clients, or simply taking a breath. That’s where a smart shift is happening across the globe, from New Zealand, Australia, and Singapore, to Canada, the UK, and the US. Businesses are choosing to hire a virtual assistant for bookkeeping rather than employing full-time staff.

But it’s not just about saving costs. It’s about operating smarter. Let’s break down why this move isn’t just practical; it’s essential.

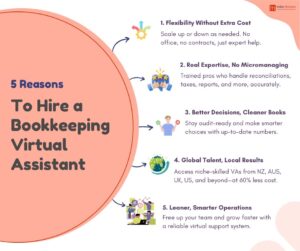

5 Reasons Why You Should Hire a Virtual Assistant for Bookkeeping

More Flexibility, Less Overhead

Hiring a local, full-time bookkeeper may sound like a safe bet—but let’s be honest, it’s expensive and inflexible.

Between recruitment, onboarding, training, workspace costs, insurance, and payroll compliance, a full-time hire can cost far more than their payslip shows. Additionally, workloads in bookkeeping are inconsistent. You might need someone for 10 hours a week during slow months but 40+ hours during tax season. Are you paying someone to sit idle for half the year?

When you go with virtual assistance services that too with a provider that specializes in accounting, you gain the flexibility to scale services up or down as per your business needs. No long-term contracts. No sunk costs. Just expertise when you need it.

And here’s something most people forget: bookkeeping is now largely a digital job. Cloud accounting tools, such as Xero, QuickBooks, MYOB, and Zoho Books, enable remote professionals to work as effectively, if not more so—than someone sitting in your office.

That’s why more small businesses, accounting firms, and even agri-based companies across New Zealand, Australia, and Europe are outsourcing it to virtual assistants who specialize in this.

Expertise Without Micromanagement

One of the biggest myths around virtual assistants is that they only handle basic admin. That may be true for generic freelancers but not for specialized bookkeeping VAs.

These are trained professionals. Many have worked with CPAs, finance directors, and even CFOs before. They know how to:

- Reconcile multi-currency accounts

- Track GST, VAT, or BAS filings accurately

- Follow country-specific compliance norms

- Generate timely P&L and balance sheet reports

- Catch inconsistencies in reconciliations and supplier ledgers

- Prepare clean, audit-ready books

The result? Fewer errors. Faster closings. No tax-time surprises.

Better Decisions, Cleaner Books

Messy books don’t just annoy your accountant, they stall your decisions.

Without real-time, accurate numbers, you’ll delay funding discussions, miss cash flow warnings, and make hiring or investment decisions based on gut rather than data. It’s not just about compliance—it’s about clarity.

A good virtual assistant doesn’t just ‘do the books’. They give you reliable data to work with. Whether you’re launching a new service in Australia, purchasing new farm equipment in New Zealand, or reviewing profitability in the UK, you’re making informed decisions based on up-to-date, organized financial information.

And if your VA works closely with your accountant or finance manager, they can create workflows where reports are ready before review meetings, anomalies are flagged early, and questions get answered with zero back-and-forth.

This kind of smooth backend setup isn’t just a luxury anymore—it’s a baseline expectation in most modern businesses.

Wider Talent, Lower Cost

Here’s something nobody tells you when you hire locally: talent shortage is real especially when you’re looking for someone who understands niche accounting requirements—like farm accounting, payroll for seasonal workers, or multi-country GST rules.

When you hire a virtual assistant, you open access to a much wider talent pool. You’re not limited to your city or even your country. You get specialists who have already worked with businesses like yours—sometimes in your industry, sometimes in your country.

For example, our assistants have worked with:

- Agri-businesses in New Zealand

- E-commerce sellers in Australia

- Legal and financial firms in Canada and the UK

- Startups and outsourcing firms in the US and Singapore

They know how to tailor the bookkeeping process to fit different tax calendars, industry quirks, and accounting software.

And the best part? You often pay 60–70% less than you would for a local hire without compromising on skill or output.

Leaner Operations, Smarter Growth

This isn’t just about outsourcing. It’s about keeping your business lean, efficient, and competitive.

When you’re not bogged down by the admin, your team performs better. When you’re not overstaffed for low seasons, you stay profitable. And when you have someone keeping your books in order at all times, your decisions become sharper and faster.

In short, you become more agile.

And if you’re in a fast-changing industry or economy (like most of us are), agility isn’t a bonus. It’s a survival tactic.

Final Thought 💭

If your bookkeeping is slowing you down or, worse, stressing you out, it might be time to rethink how you’re handling it.

Hiring an in-house team is one way. However, suppose you’re looking for a smarter, more scalable, and cost-effective approach. In that case, it’s time to hire a virtual assistant for bookkeeping who understands the job and seamlessly integrates into your workflow.

At Indian Muneem, we’re not a VA directory or freelancer platform. We’re a specialized team helping global businesses stay sharp with remote bookkeeping, payroll, and financial admin, without the bloated costs.

Let us match you with a bookkeeping virtual assistant who’s trained, trusted, and ready to get started.