Outsourcing tax preparation services isn’t just for giant corporations anymore. From lean startups to tax-burdened small businesses, more people trust external experts to handle their returns.

But is it smart to hand over your financial data to someone halfway across the globe? Does it save you time and money? And what are the trade-offs you should be aware of before outsourcing your taxes?

Let’s break down the real-world pros and cons of outsourcing tax preparation services with practical insights for businesses and professionals across the globe. No jargon. No fluff. These facts help you decide if tax outsourcing is right for you.

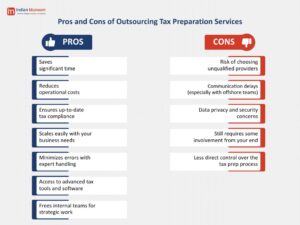

Here’s a Quick Look At The Pros And Cons of Outsourcing Tax Preparation Services

The Real Benefits of Outsourcing Tax Preparation Services

Let’s look at what makes tax outsourcing so popular (especially in high compliance countries like NZ, the UK, and the US).

1. Significant Time Savings

Tax preparation takes up a lot of time. Gathering necessary financial information, cross-checking deductions, and updating forms is a tremendous waste of hours. Outsourced tax teams allow you to take this burden off your plate and concentrate on your actual business growth (or non-spreadsheet life).

2. Expert Tax Compliance

Laws change. Fast. Especially in places like New Zealand (IRD), Australia (ATO), or the US (IRS). A reliable tax preparation company stays updated with current rules and ensures your filings are fully compliant. No missed deductions. No surprise penalties.

3. Lower Costs vs In-House Hiring

Hiring a full-time tax expert means salary, software, training, and benefits. Outsourcing tax preparation services means paying only for the work done, with no overhead. This is perfect for seasonal needs or growing businesses that aren’t ready to expand their team.

4. Scalable Support Year-Round

From GST returns in NZ to 1099 forms in the US, your filing needs might change during the year. Offshore tax services scale up or down with ease. Need help during tax season only? No problem. Got a backlog in June? Still covered.

5. Access to Latest Technology

Reputable tax outsourcing firms use leading accounting tools, encrypted portals, and cloud systems. You get efficient, secure, and error-free filing without buying or managing any tech.

6. Reduced Errors

Manual errors, missed forms, incorrect codes—tax prep mistakes can cost you heavily. Outsourcing brings experienced eyes to your returns, reducing human errors and giving you peace of mind.

7. More Strategic Focus

When your core team isn’t stuck in paperwork, they can focus on financial planning, cash flow strategies, and bigger business goals. Outsourcing tax compliance frees up capacity where it matters.

The Flip Side: Challenges of Outsourcing Tax Preparation Services

Like any business decision, there are cons too. Here’s what to consider before you move your tax prep offsite.

1. Choosing the Wrong Provider

This is the #1 risk. Not all tax preparation outsourcing companies are qualified. Some use undertrained staff, outdated tools, or don’t understand regional laws. You must vet your provider carefully.

2. Communication Delays

Time zone mismatches or unclear emails can lead to back-and-forth delays, especially with offshore tax services. If the firm lacks proper communication channels, small issues can become bigger problems.

3. Data Privacy Concerns

Your tax returns contain sensitive information. Weak data policies or insecure portals can lead to breaches. This is a real concern, especially for clients in the EU (GDPR), NZ, and Canada, where privacy laws are strict.

4. You Still Need to Participate

Some people think outsourcing means “set it and forget it.” However, you must still upload documents, answer questions, and review your return before filing. It’s not an entirely hands-off experience.

5. Less Control

When you’re used to reviewing every receipt yourself, handing over control can be uncomfortable. Outsourcing requires trust—and some business owners aren’t ready to delegate.

How Smart Outsourcing Firms Tackle These Problems

Now, here’s the difference between bad outsourcing and smart outsourcing and why businesses globally are choosing efficient partners.

Is Outsourcing Tax Preparation Services Right for You?

Here’s when outsourcing makes the most sense:

- When you’re running a growing business in NZ, AUS, SG, or the UK and tired of the annual tax scramble.

- If you’re a CPA or accounting firm looking to expand capacity without expanding payroll.

- You want to reduce errors and ensure compliance without burning out your in-house team.

- You’re spending more time doing taxes than running your business.

Outsourcing isn’t about cutting corners; it’s about smart delegation. When done right, it turns tax season into just another box to tick calmly, correctly, and without drama.

Final Thoughts: Smart Tax Moves Start With Smart Partners

At the end of the day, outsourcing tax preparation services is a strategic shift. One that lets you work smarter, not harder. But it only works when you choose the right partner.

Whether you’re a business owner drowning in receipts or an accounting firm that needs backup during the busy season, outsourcing smartly can help.

Ready to take the stress out of tax season?

📢 Let’s talk. No obligations, just honest advice and a better way to handle taxes.